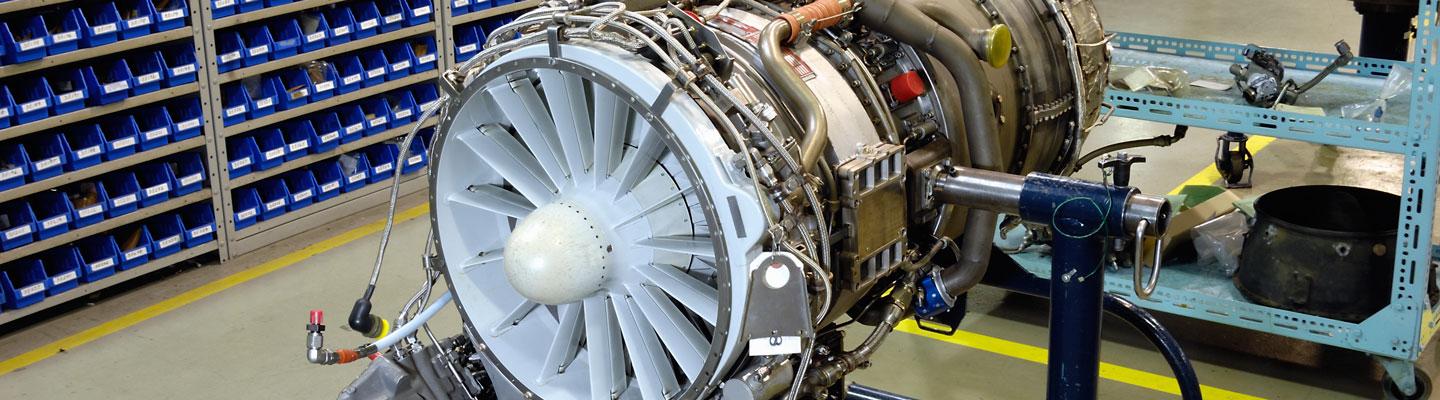

For this first article in a series about building aircraft, we focus on engine parts and components, highlighting the real-world problems tooling makers help their customers resolve every day. We also take an in-depth look at what’s going on in and around aerospace part-making right now.

What’s the state of the aerospace and defense industry right now? The push to build aircraft fast and deliver on time is very real—but it’s not without its obstacles or costs.

At the part-making level, heat-resistant and composite materials can be downright tough to cut. Consequently, aerospace manufacturers are having to become very strategic in their process engineering, machine programming and tool selection, according to three major tooling makers we interviewed.

Becoming strategic is very true for all of the complex components that make up a jet engine where individual $75,000 forged parts are the norm—and scrapping one is an expensive, undesired option. Speed, while essential, does not take precedent over predictable, reliable outcomes.

Aerospace and Defense: Production Boost Means Advanced Tooling Strategies Are Needed

“As we see original equipment manufacturers increase production rates, there remains a risk of suppliers facing difficulties in ramping up production,” says Robin Lineberger, the leader of Deloitte’s aerospace division, in the “2019 Global Aerospace and Defense Industry Outlook” report. “To overcome this challenge, manufacturers should consider deepening their focus on strengthening the supply chain, effective program management, and the use of advanced technologies to enhance productivity and efficiency.”

In its report, Deloitte expects 2018 to close with some 1,600 aircraft for the year—and predicts 100 more than that coming for 2019. The production demand often means using higher throughput and multitasking machines. The “advanced technologies” it mentions include everything from in-process sensor-based metrology to high-speed, multiaxis machining to highly engineered, specialty tooling intended for whatever material specifications this highly regulated industry throws its way.

What Deloitte doesn’t point out is that an advanced 5-axis machine can take six months to a year to arrive. So while those are on back order, some subcontractors are managing with existing 3-axis systems or other aging machinery—and many finished aerospace parts “suppliers” are having to rethink tooling strategies while they wait, explain tool makers.

“They want quicker ways of manufacturing,” says Bill Durow, a global engineering manager with a focus on aerospace at Sandvik Coromant. “They want to run them at higher speeds whether roughing or finishing. Today, the volume of engines that are being produced are at a rate we’ve never seen before in the industry.”

Talk to Us!

Leave a reply

Your email address will not be published. Required fields are marked *