“Without price stability, the economy does not work for anyone,” he said in a September news briefing posted on the Fed’s website. “Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run. We will keep at it until we are confident the job is done.”

The Fed’s benchmark rate may rise to 4.4 percent by the end of this year, the median projection of monetary policy committee members, and to 4.6 percent by the end of next year.

While economic fluctuations coupled with a tight labor market have made this year quite “a ride,” Harris says, today’s environment reflects changes that began years before. Those include:

- The widening retirement of baby boomers, people born from 1946 to 1964, who make up one of the largest generations in U.S. history;

- Rapid expansion of the financial economy versus the real economy of goods and services;

- Underinvestment in energy production and exploration;

- Development of ultra-efficient supply chains that enabled just-in-time inventory management but had very little resiliency.

'Moments of Truth'

Understanding those trends and how the events of the past two years, from shipping disruptions to international conflicts, government stimulus payments and low interest rates, heightened their impact helps with both navigating current economic challenges and identifying new opportunities, she says.

“These are moments of truth,” Jason Heinrich, a senior partner in Bain’s Chicago office, says in the forum. They are also moments of opportunity, he says, “especially for those firms and businesses that are navigating these issues from a position of strength.”

Businesses crafting a strategy to carry them through inflation and other challenges should consider four key questions, he says:

- How strong is customer demand, and what changes do you expect in the next one to two years?

- How do you expect inflation to affect your business, and what actions can you take during the next three months and, then, the next year?

- How much efficiency should you give up to build or maintain resiliency?

- How can you make your strategic planning more dynamic “in a world that seems to be experiencing shocks at a much more frequent pace?”

A variety of tactics can help manufacturers regain their footing—and even gain momentum—despite the barrage of challenges. Here’s a look at some of the steps he suggested during the forum as well as measures identified by other consulting firms and industry experts.

1. Double Down on Customer Engagement

“Driving customer loyalty during these periods of time is extremely important,” Heinrich says. “You need the business intelligence to do that in a sophisticated way, targeting customer segments that may have a disproportionate inflationary impact.”

Figuring out what customers want and meeting the needs of those who require more help than usual is crucial, he says.

As supply costs rise, he adds, determine where your business can absorb them and the best times and methods for passing them on to customers.

2. Improve Your Purchasing Process

With across-the-board price increases already reaching limits of what many customers will absorb, companies are devising more surgical approaches, Heinrich says.

The savviest are getting creative about “exchanging price for other types of value, bundling products and adjusting service levels,” he says.

Manufacturers, in particular, are reviewing order backlogs built up when their own supply costs were lower and seeking ways to recoup some of the value lost as materials prices increase.

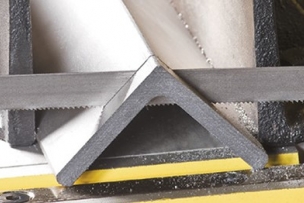

Businesses may be able to curb the impact of inflation by finding suppliers whose expertise includes services that will help lower the overall operating cost. One example for machine shops is MSC Millmax, which helps optimize productivity and tool life by using data from a tap test that determines optimum configurations of tools, spindles and workpieces.

Even when a price increase for raw materials appears unavoidable, there may be ways to minimize cost, consulting firm McKinsey & Co. says in a report. Striking a deal with a vendor to help fund promotions that limit the increase passed on to customers can provide an immediate benefit and may help develop what the firm calls a strategic supplier relationship.

3. Focus on Your Supply Chain

Heinrich recommends pressure-testing price increases for your raw materials to make sure they’re fair and reasonable and, if necessary, reconfiguring your supply chain to avoid regions of geopolitical instability.

Maintaining higher levels of inventory may help, too, given the possibility of further supply-chain disruptions and the increasing cost of financing future purchases as interest rates rise.

For metalworkers, vendor managed inventory services such as MSC’s ControlPoint vending can boost efficiency significantly by avoiding stockouts and obsolescence. They range from almost totally automated to more hands-on options, depending on customer preference.

4. Find Smart Ways to Take Advantage of Automation

Most companies find it difficult to add automation at a broad-enough scale to make a material difference, Heinrich says.

Avoid such pitfalls by making sure the automated equipment you buy has the capacity to do what your business needs and that it delivers the expected return on investment.

“There are lots of good experimentation and pilot programs that dabble in automation, but for the most part, the big struggle around automation is actually scaling it up across the business and getting a real return on that,” he explains.

Talk to Us!

Leave a reply

Your email address will not be published. Required fields are marked *