How a Deadly Bridge Collapse May Bring Home U.S. Manufacturing

Supply chain disruptions like the bridge collapse that blocked the Port of Baltimore in early 2024 are heightening interest in reshoring American manufacturing.

Supply chain disruptions like the bridge collapse that blocked the Port of Baltimore in early 2024 are heightening interest in reshoring American manufacturing.

The deadly collapse of Baltimore’s Francis Scott Key bridge this year not only disrupted shipping at one of the busiest U.S. ports but also reignited debate on whether American manufacturers should move production back inside the country—or at least closer to it.

The Port of Baltimore is among the top 20 U.S. ports by shipping volume, and the fourth largest on the eastern U.S. Coast, handling 37.4 million tons of goods a year, according to recent statistics. It’s also the country’s top automobile port, moving more than 750,000 vehicles in 2022.

The port’s almost-total blockage after the container ship MV Dali’s collision with the bridge was reminiscent of the 2021 grounding of the MV Ever Given, which blocked the Suez Canal for close to one week, aggravating supply chain disruptions caused by the 2020 pandemic.

With large swaths of the economy shuttered for health reasons, dozens of cargo ships sat idle off the coasts of California, Shanghai, Singapore and elsewhere during that time, illustrating the weaknesses in just-in-time inventory management practices that relied on intricate global supply chains.

The same supply chains are also vulnerable to a variety of other events, from cyberattacks to severe storms, labor strikes and military conflicts.

The result? Delayed delivery of the goods and supplies needed to keep businesses operational, often driving up costs and fueling inflation. Many companies failed as a result, forcing their workers to seek employment elsewhere.

The U.S. is just one of the countries where manufacturers have responded by reevaluating how to source the supplies they need. Many have already begun the arduous process of bringing production back home (reshoring) or at least closer to home (nearshoring).

The latter gives manufacturers and their suppliers the advantage of lower labor costs without incurring much risk. Moving production to Mexico, for instance, means there’s far less chance of disruption due to port closures. It also offers benefits such as reduced shipping costs, easier communications and shorter lead times.

Similarly, companies looking to reshore their manufacturing operations are finding that automation and digital technologies have gone a long way toward leveling labor costs that have historically been higher in the U.S., especially when producers and machine shops can make the leap to lights-out or lightly attended operations.

The U.S. government recognizes the urgency of the situation. Late last year, it announced dozens of supporting initiatives, including the creation of the Council on Supply Chain Resilience, additional investments in the Advanced Energy Manufacturing and Recycling Grant Program and Energy Department sponsorship of a study by the National Academies of Science, Engineering and Medicine to develop a nationwide plan for smart manufacturing.

Those moves are in addition to investments to strengthen supply chains and expand U.S. production through the CHIPS and Science Act, the Inflation Reduction Act and the Bipartisan Infrastructure Law.”

Private industry is also taking important strides. Some 79 percent of supply chain leaders surveyed in 2023 implemented or started implementing dashboards for enterprise-to-enterprise visibility, Jason Li of consulting firm McKinsey and Co. explains in this article from Inbound Logistics.

“In 2024, we will see an even stronger emphasis on demand and supply planning across the value chain, with 71 percent of leaders reporting they expect to prioritize data-driven approaches,” he states.

And Dario Ambrosini of Propel Software, a provider of product lifecycle management tools, notes in the same article that “those with modern tech stacks will find it easier to leverage artificial intelligence to drive true impacts to both top and bottom lines.”

Scratching your head over the term “modern tech stack”? Not ready for artificial intelligence? The vast majority of small- to medium-sized enterprises aren’t either.

Many of these job shops, tool and die houses, sheet metal fabricators and others continue operating just as they have since long before the pandemic highlighted the fragility of global supply chains.

And there’s the rub. Nearshoring, and especially reshoring, stands a far greater chance of success when companies embrace newer technologies.

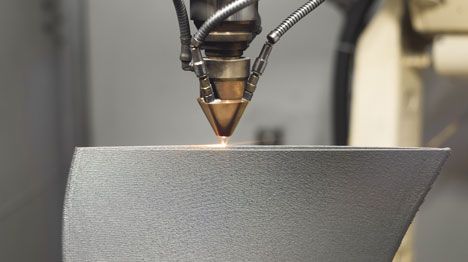

That doesn’t necessarily mean AI, but rather simpler, more concrete steps like robotic machine tending, advanced CNC machinery and digital manufacturing tools.

What are these digital tools? We’ve discussed many of them here on Better MRO. Search for terms like Industry 4.0 and the Industrial Internet of Things (IIoT) and you’ll find dozens of articles discussing these and related topics.

Each is relevant to manufacturers of all shapes and sizes, and each represents technologies that shops must grapple with if they’re to avail themselves of the upcoming reshoring possibilities.

Not ready for that either? That’s OK. Even small continuous improvement projects can bring big rewards. Begin with a lean manufacturing initiative. It’s cheaper than you might think and will help create a mindset that change is good.

String some Ethernet cables and start collecting production data from your CNC machine tools. Many shops see a return on investment within weeks. Moreover, they can brag about it to potential customers, illustrating that they’ve begun moving down the digital manufacturing path.

Similarly, it’s quite easy to begin gathering quality data, install an offline tool presetter or in-machine probing system, pick up a 3D printer or move to a zero-point workholding system. These and countless other small-scale investments will open the door to greater efficiency, production throughput and part quality.

Of course, it’s tough to tackle new projects or take on work from new customers when you can’t find skilled labor. This industry-wide problem is possibly the biggest obstacle to reshoring and nearshoring.

As noted earlier, robots and cobots will help address some of this shortcoming. But as anyone who’s tried it already knows, successful automation depends on predictable processes—if these don’t exist, begin there.

Skilled labor will always be needed, however, no matter how automated or high-tech the shop. The good news is that even a few hours of unattended operation will not only improve the shop’s bottom line but also provide more time for mentoring, training and documentation, all of which are needed to bring the next generation of workers up to speed.

All of this is going to take time—as in years. Start now. The shops most willing to grab the technology ball and run with it will be the best prepared for a resurgence in North American manufacturing. Will yours be one of them?