Industry 4.0: Manufacturing Skills Needed in Smart Factories

Future skills matter. See what experts from Intel and the Smart Manufacturing Institute say are the most important.

Future skills matter. See what experts from Intel and the Smart Manufacturing Institute say are the most important.

What happens when the worlds of IT and OT have to be more closely aligned than ever before? We talk to manufacturers on both sides of the equation about the skills needed for “smart factory” workers and the cultural barriers that have limited wide-scale adoption to date.

Industry marketers call the smart factory or smart manufacturing the “convergence” between information technology and operational technology. Analysts and consultants forecast manufacturing’s future, and it’s downright digital.

“Forty percent of the workforce is retiring or reaching retirement status in the next three to five years, which is huge,” says Dr. Irene Petrick, a senior director of industrial innovation in the internet of things group at Intel, in an interview with Better MRO. “Automation will be a necessity.”

Most companies today, despite investing in new technologies, are not yet near the promise of Industry 4.0 where there is a complete integration of an optimized supply chain married to the factory floor and on-time delivery, says Mike Yost, outreach advisor for The Clean Energy Smart Manufacturing Innovation Institute (CESMII), in an interview with Better MRO.

“The reality is that many companies are doing plenty of ‘smart’ today and have been,” says Yost. “It drives me nuts how fragmented we are in the industry in the language we use … There’s a danger in defining these terms and thinking they are a final destination … We’re now evolving in every dimension, but no one is doing all of it.”

Why? It’s really complicated.

“Bottom line: The caution among manufacturers in going digital isn’t about a lack of internal strategic alignment and short-term focus. The world of manufacturing is complex,” says Stephen Gold, president and CEO of Manufacturers Alliance for Productivity and Innovation (MAPI) in the 2018 article “Manufacturers are Behind in Industry 4.0—and for Good Reason.”

Is more precise and accurate predictive maintenance happening? Yes. Automated systems, such as autonomous guided vehicles and artificial intelligence, are making their way to the machine cell and warehouse floor.

Software is getting smarter on machines. Mazak, for example, now has a spindle health monitoring system option for its horizontal machining centers. Makino has shown off voice-command technology for machine operations developed by the startup iT SpeeX.

“There are countless pieces to this puzzle, and the technology piece is likely not the hardest to solve,” says Gold. “While manufacturing companies can differ dramatically … they all share certain characteristics, such as increasingly complex supply chains, using production assets for decades before replacement, and the very real need to avoid production downtime at all costs.”

Business leaders in manufacturing have been hearing about “having the right data at the right time” for 25 years or more, though, says Yost.

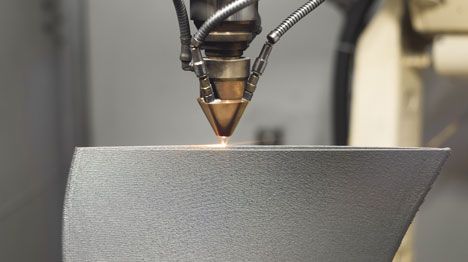

What’s the difference today? There are a lot more digital software and intelligence tools, probes and smart sensors in the toolkit that can be used to help manufacturers reach their competitive and efficiency goals than ever before. New materials have arrived—and new ways of manufacturing by 3D printing or “additive” techniques.

With that, there are new, hybrid skills needed that combine operational and machining technology expertise with digital and data skills.

“They’ll need to understand data, be able to analyze it and use statistical thinking toward it,” says Petrick. “Data needs to drive action to be useful.”

Petrick leads research at Intel focused on the OT and IT divide—and is able to study Intel as a manufacturer and a technology company. Last year, the company published research, “Industry 4.0 Demands the Co-Evolution of Workers and Manufacturing Operations,” that surveyed 145 participants.

“But they’ll also need to trust the true picture of data they see on a dashboard … Mistrust is a major takeaway from our research,” she says.

Petrick believes the skills of a data scientist will be in demand, but they will be hard to come by. They already are today. Additional skills include: technical robotic and automation expertise, virtualization, advanced programming, advanced vision (cameras), collaborative robotics simulation and augmented reality applications.

Let’s put “understanding data” in more context: When you have the ability to monitor a large volume of smart signals, how do you separate out the anomalies?

Without question, Industry 4.0’s smart factories will heavily lean on data. Workers will need the skills to help find the anomalies, define what the “right” data is to be monitoring—and create the appropriate failovers that trigger alternative production paths and contingencies.

“Workers will need critical problem-solving skills, and be able to identify the problems before solving them,” says Yost.

Where are things headed at the machine level? Read “Ask An Expert: Georgia Tech Professor on the Future of Machining.”

This is not an easy task given the skills gap. This is not to say experienced shop floor workers lack these skills today. Nor does it mean new talent won’t understand previous technologies and techniques.

But what happens when those with the most OT experience are no longer working?

“The future workers entering the manufacturing environment are digital natives who are comfortable with—and expect—data, in order to drive transparency. However, these digital natives lack production experience,” writes Petrick in an article for IndustryWeek. “The current workforce possesses production experience, but lacks data knowledge. We need training programs that link these two populations and their belief systems to implement the future intelligent factory.”

Based on Intel’s research, Petrick discovered that the cultural challenges between IT and OT are the biggest hurdles facing manufacturers.

“There are deeply held philosophies on both sides, and they are hard to combine,” she says. “Companies need to engage all stakeholders in this transformation—and have experts at the table from all sides.”

It means collaborating, partnering and mentoring across peer groups—and communicating and coordinating all the time. Process engineers need to work side by side with IT teams.

“If you’re only thinking about process efficiency, you’re likely not focused on the security of the systems,” says Petrick. Hence, give a seat at the table to IT.

It also requires a bit more systems planning and integration knowledge. It may require hiring external expertise, such as systems integrators who Petrick says are rated highly in the industry since they are technology and vendor agnostic.

“Tech today is often adopted without any plan in place to keep it updated. Several factories have ended up with new machines and old computer interfaces, new data streams and old servers …” says Intel in its co-evolution research.

Other soft skills include communication and being committed to lifelong learning and education. It appears, however, that many manufacturers are behind the curve on training.

“In programming, setting up, operating and maintaining smart manufacturing tools and processes, you have to see what additional aspects they [workers] need training on,” says Jeannine Kunz, vice president of Tooling U-SME, in an article on the skills gap. “Unfortunately, manufacturing has been below average in investing in training on a per-employee basis.”

Predominantly, predictive maintenance tasks are being helped by smart technologies—which aids a plant’s flexibility. When you know the status of all your machines and know when failure will occur, “you can dramatically reduce downtime,” says Petrick.

Simply put, there’s more throughput to realize from the depth of information available.

“When you have more insight into what you can adjust, the opportunities for cost-savings and efficiency multiply,” says Petrick.

But it’s not necessarily happening in every sector. The automotive and food and beverage sectors are seeing notable upticks—and getting “smarter” each year, according to Petrick.

Automotive is dealing with mass customization of vehicles by consumers as well as pressure from global dynamics and autonomous vehicles.

The food industry has a lot of new products that fail, so food manufacturers want to fail fast and adjust. They also have the added consumer pressure for fresh ingredients, so they seek tighter manufacturing controls and want more flexibility in taking time out of processes. Being smart about processes and technologies is helping.

Are digital technologies actually making an impact in your shop yet? Talk about it in the forum. [registration required]

Back in 2016, the U.S. Department of Energy selected a leadership coalition to develop a public-private partnership focused on applied research and development of smart manufacturing technologies with dedicated funding of $140 million. Half of the funding is subsidized, and the other half has come from the manufacturing and energy industries.

The resulting body is a consortium called The Clean Energy Smart Manufacturing Innovation Institute with 200 partner members and a mission to “enable rapid technology adoption to increase productivity, job growth, energy efficiency, safety and time to market for companies of all sizes,” per its website. It’s been in action for two years.

“This initiative is a mandate from DOE to help revitalize American manufacturing,” says Mike Yost, a 30-year industry veteran in industrial automation, and the outreach advisor for CESMII. “And this applies beyond just technology. There is a major workforce development requirement to this as well, including working with underrepresented groups, such as veterans, women and minorities.”

A major target for CESMII will be directed at helping establish a thriving solution provider and workforce community for smart manufacturing. Today’s options are fragmented, and the messaging and value propositions aimed at manufacturers are being lost in translation.

In 2013, Yost believes things shifted when technology company Cisco came out with its “Internet of Everything” report that forecasted $14.4 trillion of value at stake in the internet of things—with 27 percent of that value in manufacturing. It opened technology companies’ ears.

“The first words out of manufacturers’ mouths after they hear a ‘smart factory’ pitch today are, ‘We don’t have any money for this project,’” says Yost. “It’s not resonating because it’s not in a common language manufacturers can connect to their business yet.”